When it comes to filing your Income Tax Return (ITR), choosing the right form is […]

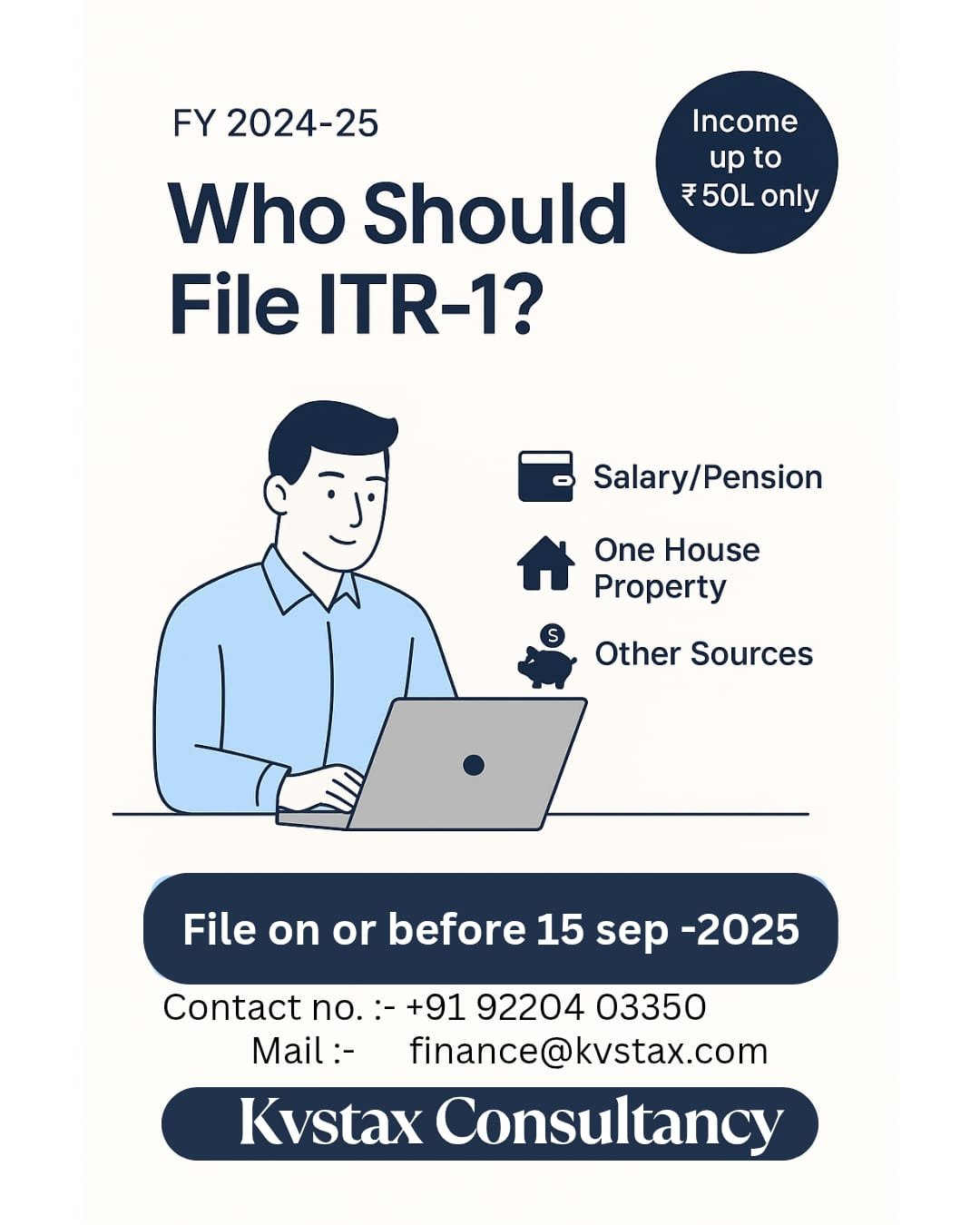

ITR-1: The Right Tax Return for Salaried Individuals

If you’re a salaried person living in India, own just one house, and your total […]

ITR Filing Got Further Simplified: Who Should File ITR-1 (Sahaj)? By KVSTAX Consultancy

Filing Income Tax Returns (ITR) is a crucial responsibility for every eligible taxpayer in India. […]

✅ Important Precautions After GST Registration: A Simple Guide for Business Owners

✅ Important Precautions After GST Registration: A Simple Guide for Business Owners So you’ve just […]

New Tax Regime vs. Old: Which Works Better for Salaried Employees in 2025?

New Tax Regime vs. Old: Which Works Better for Salaried Employees in 2025? If you’re […]

🤔 Confused Between Old and New Tax Regimes? Here’s How to Choose the Right One Before Filing Your ITR

🤔 Confused Between Old and New Tax Regimes? Here’s How to Choose the Right One […]

Here’s a simplified version of the Income Tax Slab for FY 2024-25 and FY 2025-26, explaining both the Old and New Tax Regimes:

Here’s a simplified version of the Income Tax Slab for FY 2024-25 and FY 2025-26, […]

Income Tax Slabs for 2025-2026: Everything You Need to Know

Income Tax Slabs for 2025-2026: Everything You Need to Know The Indian taxation system is […]

“Budget 2025 Expectations: How Indirect Tax Reforms Will Shape India’s Growth Trajectory While Ensuring Fiscal Discipline”

“Budget 2025 Expectations: How Indirect Tax Reforms Will Shape India’s Growth Trajectory While Ensuring Fiscal […]

Budget Expectations from My Side:

Budget Expectations from My Side: 👉 Increase in Basic Exemption Limit for the New Tax […]