Title: New e-Way Bill System Feature: Enrolment of Unregistered Dealers via Form ENR-03

Introduction

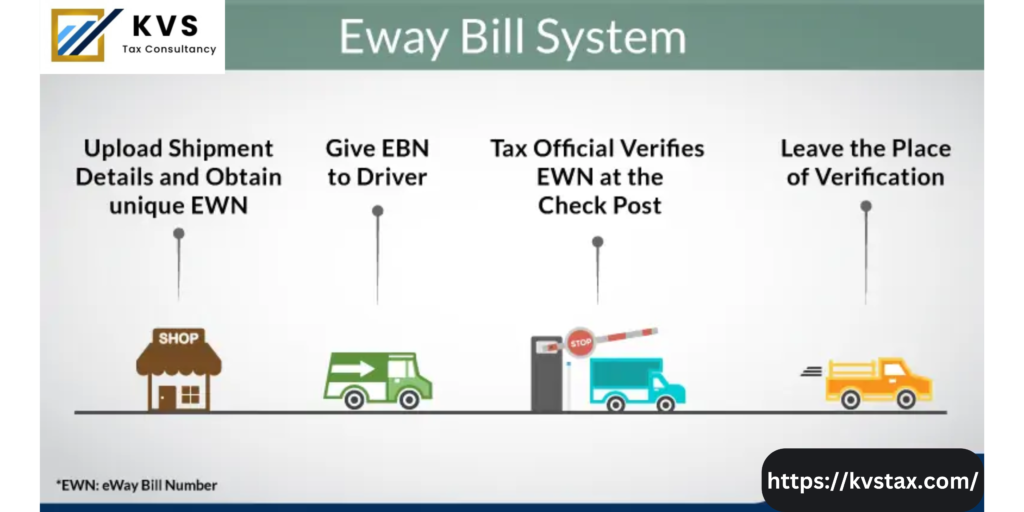

The Goods and Services Tax Network (GSTN) has introduced an essential feature in the e-Way Bill (EWB) system that aims to streamline the enrolment of unregistered dealers. Effective from February 11, 2025, unregistered dealers who supply goods and are engaged in the transportation or movement of goods can now easily generate e-Way Bills by enrolling themselves on the EWB portal. This process is crucial for ensuring compliance and efficiency in the transportation of goods under GST rules.

In this post, we will walk you through the details of Form ENR-03, a new form introduced to facilitate the enrolment of unregistered dealers, and guide you on how to use it effectively.

What Is Form ENR-03?

Form ENR-03 has been introduced in accordance with Notification No. 12/2024 dated July 10, 2024. This form allows unregistered persons (URPs), including those without a GSTIN, to enrol themselves on the e-Way Bill portal. By enrolling, these dealers can generate e-Way Bills using a unique Enrolment ID, which acts as a substitute for the usual Supplier or Recipient GSTIN.

Key Features of the New System

- Who Can Use Form ENR-03?

- Unregistered Dealers engaged in the movement or transportation of goods.

- Any individual or entity that is not registered under GST but needs to generate e-Way Bills for goods transportation can now enrol through this form.

- The Enrolment ID

Once successfully enrolled, the dealer receives a 15-character Enrolment ID, which can be used for generating e-Way Bills. This unique ID serves the same purpose as the GSTIN for both Suppliers and Recipients when generating the e-Way Bill.

Step-by-Step Guide for Enrolling Using Form ENR-03

Step 1: Access the ENR-03 Form

To start the enrolment process:

- Visit the e-Way Bill Portal.

- Navigate to the Registration tab in the main menu.

- Select the option for Form ENR-03, which will allow you to enrol as an unregistered dealer.

Step 2: Fill Out the ENR-03 Form

Once you access the form, follow these instructions:

- Enter PAN Details: The applicant must provide their PAN (Permanent Account Number), which will be verified by the system.

- Select Enrolment Type: You’ll need to choose the type of enrolment you require.

- Address Details: Provide your full address, as it will be used to verify your enrolment request.

- Mobile Number Verification: Enter your mobile number, which will be verified via OTP (One-Time Password).

Step 3: Create Login Credentials

After filling out the necessary details:

- Username and Password: Create a username, check its availability, and set a password for your account.

- Submission: Upon successful submission, the system will generate a 15-character Enrolment ID for you.

- An acknowledgment will be displayed confirming the successful enrolment.

Step 4: Generating an e-Way Bill

Once enrolled, you can start generating e-Way Bills:

- Log in to the e-Way Bill Portal using your newly created credentials.

- Select the ‘Generate New’ option for e-Way Bill creation.

- The Enrolment ID will be auto-populated in place of the Supplier/Recipient GSTIN.

- Enter the remaining required details and generate the e-Way Bill.

Why Is This Important?

The introduction of Form ENR-03 simplifies the process for unregistered dealers, enabling them to easily comply with GST rules without needing to be registered under GST. This ensures that all goods movement, whether conducted by registered or unregistered persons, stays in line with e-Way Bill requirements, promoting smooth and efficient transportation of goods across India.

Need Assistance?

For further assistance regarding the ENR-03 process or troubleshooting any issues related to e-Way Bill generation, taxpayers can:

- Contact the GST Helpdesk.

- Refer to the detailed User Guide attached: User Manual for ENR-03.

Conclusion

The introduction of Form ENR-03 marks a significant step in improving the efficiency and accessibility of the e-Way Bill system for unregistered dealers. By providing an alternative to the traditional GSTIN-based e-Way Bill generation, this move ensures greater compliance and reduces barriers for businesses and individuals involved in goods transportation.

Stay informed and ensure your business is compliant with the new regulations. Visit the e-Way Bill portal today to complete your enrolment and begin generating e-Way Bills!

Thank you,

Team GSTN

Disclaimer:

The information provided in this blog is for general informational and education purposes only and does not constitute financial, investment, or professional advice. Always conduct your own research or consult with a qualified financial advisor before making any investment decisions. Investing involves risk, and there is no guarantee of returns. The views expressed here are solely those of the author and do not reflect the opinions of any financial institution, company, or organization. KVSTAX is not responsible for any financial decisions or actions taken based on the content of this blog.