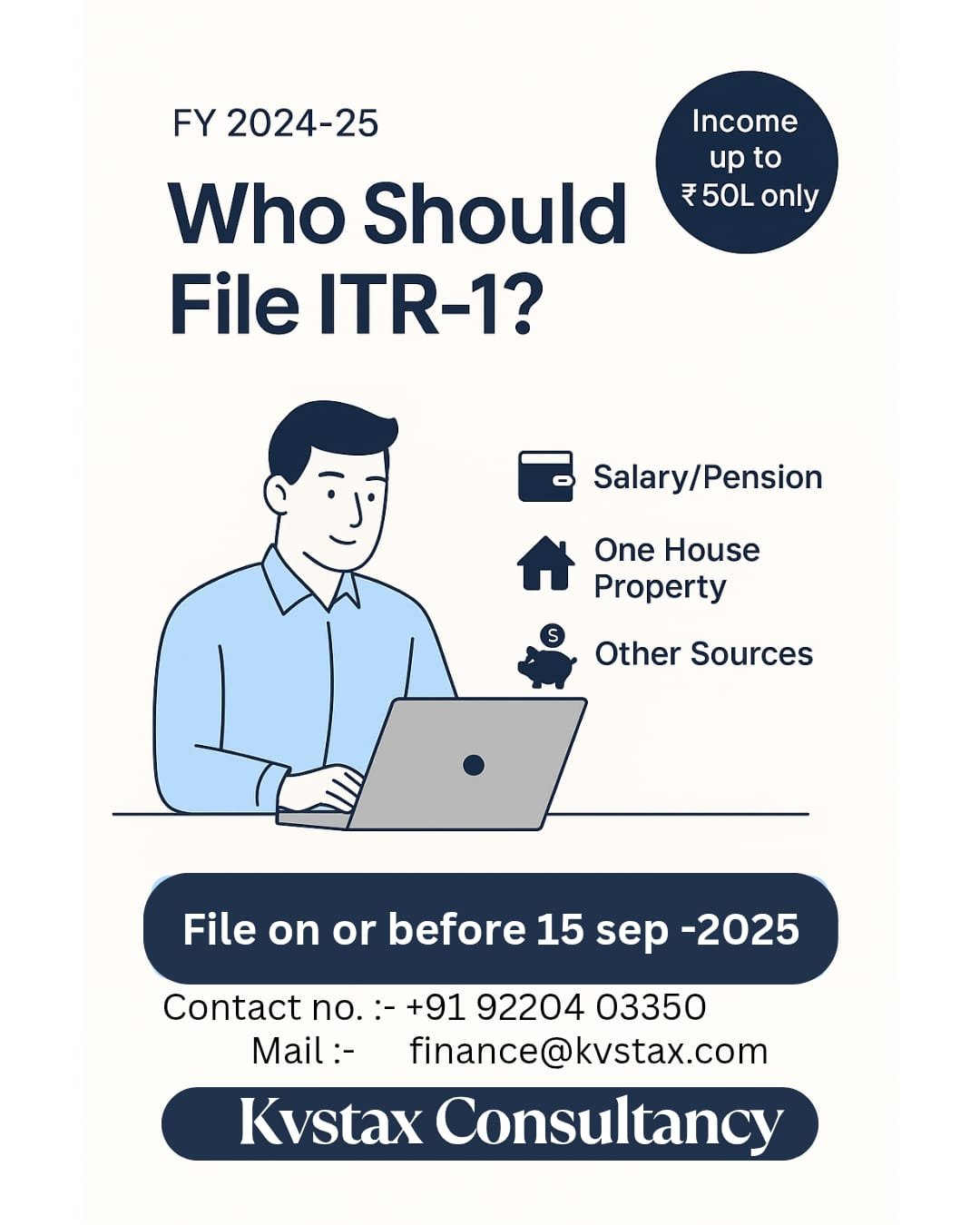

If you’re a salaried person living in India, own just one house, and your total income is under ₹50 lakhs, then ITR-1 is the form you need to file your income tax return.

Filing your ITR might sound complicated, but it’s actually quite simple—especially when you know which form is right for you. Let’s understand what ITR-1 is and who can use it.

✅ What is ITR-1?

ITR-1, also called Sahaj, is an income tax return form for resident individuals. It is the most commonly used form by salaried taxpayers.

This form is designed for people with straightforward sources of income. You don’t need to worry about complex calculations if your income is simple and clear.

👨💼 Who Can File ITR-1?

You can file ITR-1 if you meet all of the following conditions:

- You are a resident individual (not an NRI).

- Your total income is ₹50,00,000 or less in the financial year.

- Your income comes from:

- Salary or pension

- One house property (owned or rented out)

- Other sources, such as:

- Interest from a savings bank account

- Fixed deposits

- Family pension

If all your income falls under the above categories, ITR-1 is perfect for you.

❌ Who Cannot File ITR-1?

You cannot use ITR-1 if:

- Your total income is more than ₹50 lakhs

- You have income from business or profession

- You have more than one house property

- You are a Director in a company

- You hold unlisted shares

- You have foreign assets or foreign income

- You are not a resident (i.e., NRI)

In such cases, you will need to file a different form like ITR-2 or ITR-3, depending on your income sources.

📅 What is the Due Date for Filing ITR?

For most salaried individuals, the due date to file ITR for the Financial Year 2024–25 (Assessment Year 2025–26) is 15 September 2025

Filing after the deadline may attract penalties, interest, or even restrictions on carrying forward certain losses. So it’s best to file early and stay stress-free!

📝 Why Should You File Your ITR?

Even if your employer has deducted TDS (Tax Deducted at Source), you should still file your ITR because:

- You may be eligible for a tax refund

- It acts as proof of income

- It helps in loan approvals and visa applications

- You stay legally compliant

💼 Need Help Filing ITR-1?

Don’t worry if this still feels confusing. At KVSTax Consultancy, we help salaried individuals file their ITR-1 easily, correctly, and on time. We’ll take care of the paperwork so you can relax.

Contact KVSTax Consultancy today and let us handle your tax filing with care.

📞 Stay compliant. Stay stress-free.

📌 Disclaimer

The information provided in this blog is for general guidance and educational purposes only. It should not be considered as professional tax advice or legal opinion. For personalized assistance based on your individual or business tax situation, please consult with a qualified tax consultant or reach out to KVSTAX CONSULTANCY directly.

ITR1 #TaxFilingIndia #IncomeTax2025 #KVSTax #SalariedTaxpayer #TaxHelp #FinancialYear2024_25 #ITRHelpIndia