This Navratri, India didn’t just celebrate—it surged. With consumer demand hitting its highest in over […]

🌟 Start Your Dream Business Today — Company & LLP Registration Made EasyCompany & LLP Registration

💼 “Make It Official” — The Power of Business Registration in India’s Entrepreneurial Era In […]

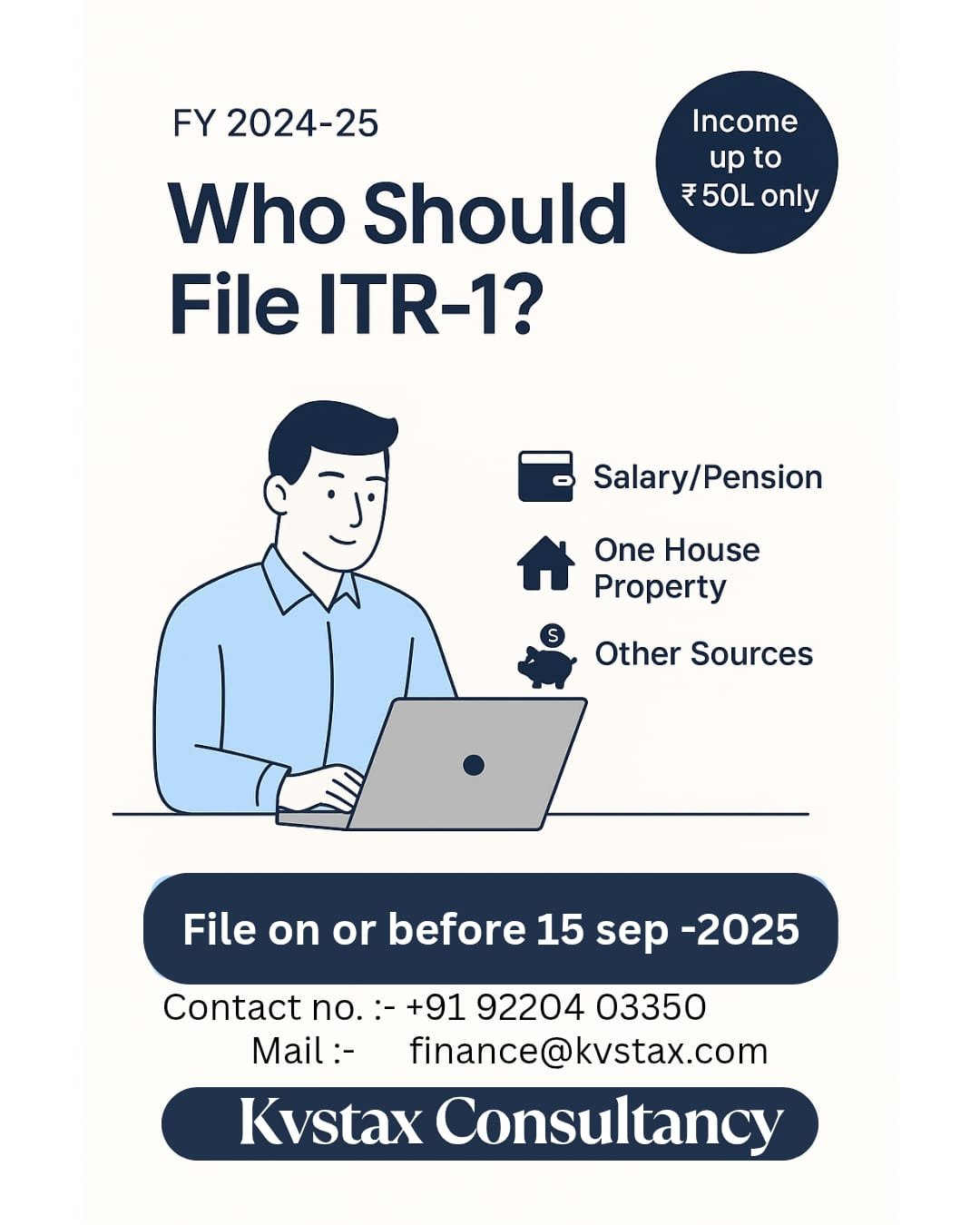

🧾 ITR-1, 2, 3 & 4 Filing for FY 2024–25 is Now OPEN!

📅 Deadline: 15 September 2025 🔔 Why Wait? File Your ITR Today & Stay Stress-Free […]

How to Choose the Right Business Structure in India: Sole Proprietorship, Partnership, LLP

Choosing the right business structure in India is crucial, as it can significantly impact your […]

📘 A Complete Guide to Partnership Deed and Its Registration in India

In India, many small and medium-sized businesses are formed as partnerships because they are simple […]

💼 ITR-2 Filing Made Easy – Who Should File and Why?

When it comes to filing your Income Tax Return (ITR), choosing the right form is […]

ITR-1: The Right Tax Return for Salaried Individuals

If you’re a salaried person living in India, own just one house, and your total […]

ITR Filing 2025: Avoid These Common Mistakes That Could Cost You Big

_________________________________________________________________________________________________________ As the July 31 deadline for filing Income Tax Returns (ITR) for the financial […]

ITR Filing Got Further Simplified: Who Should File ITR-1 (Sahaj)? By KVSTAX Consultancy

Filing Income Tax Returns (ITR) is a crucial responsibility for every eligible taxpayer in India. […]

💼 Income Tax Return (ITR) Filing for AY 2025-26: A Complete Guide for Every Taxpayer

💼 Income Tax Return (ITR) Filing for AY 2025-26: A Complete Guide for Every Taxpayer […]